What is Transformative Economic Development?

A new monthly post about economic development from Greater New Orleans, Inc. President & CEO Michael Hecht. Inspired by questions about what economic development is, why it matters, and how it can have systemic positive impact, “Transformative Economic Development” is a handbook of best practices that can be used by anyone that wants to help create a thriving economy, and an excellent quality of life, for everyone in their community. Explore the full series online.

December 9, 2021 – “Acme Corporation announces $50M investment and 300 jobs in Anytown, USA.” Accompanied by a press conference, complete with golden shovels and giant ribbon-cutting shears (these exist), this is a classic economic development headline.

Business Development is the function that delivers these economic development “wins,” the direct investment and job creation that are the ultimate measures of economic development success.

Going back to Chapter 1, if Business Environment work is about nurturing the soil to create the conditions for economic growth, then Business Development is about harvesting the fruit of that labor.

The Three Types of Business Development

There are three distinct forms of business development, all of which must be present for a healthy economy.

1) Business Attraction – Business Attraction is about getting external companies to move or expand into your home market. The two Holy Grails of Business Attraction are a manufacturing project, as the indirect job multiplier can be as high as 10x (due to suppliers, shipping, etc.); and, a headquarters relocation, because this brings not only the highest-paying jobs, but also the purchasing, philanthropy, and prestige of the C-suite.

2) Business Retention & Expansion – Though less sexy than Business Attraction, Business Retention & Expansion is arguably more important. The reason is simple: it’s easier to keep a company and help it grow than it is to bring in a new firm. (Ever heard the adage “it’s easier to keep an existing customer than to attract a new one”? Same holds here.) A local company is also “stickier” than an outside one; for both business and personal reasons, a local company is more likely to stick around for the long-haul. Unfortunately, Business Retention & Expansion doesn’t tend to garner as many headlines as Attraction, and can be politically complicated, for reasons we will explore below.

3) Entrepreneurship –Beyond attracting and growing existing companies and jobs, we can also help create new ones, via Entrepreneurship. While this is the riskiest of the three types of Business Development, the rewards can be the greatest. Here in Greater New Orleans, three post-Katrina companies – Levelset, Lucid, and Sunpro Solar – were just sold for a combined nearly $2.5B. Of this exit cash, as much as $1B will be reinvested in the New Orleans economy via employee equity and local investors, kickstarting a “fly-wheel” effect, wherein an entire cohort of new investors can now start new companies, fund new investments, and support new philanthropy.

But How Do You Do It?

Each form of Business Development has its own process and its own rhythm.

Business Attraction

Step 1: Case Development

The first step of the Business Attraction process is developing a “business case,” centered around your region’s competitive advantage. This competitive advantage may derive from a range of factors, including geography, infrastructure, workforce, universities, quality of life, and historic economic trends. Once you’ve identified your competitive advantage, you can define key sectors of interest; here in GNO, we’ve defined six: three “Foundational” industries that have driven the economy historically (Trade, Energy, and Advanced Manufacturing) and three “Diversifying” industries that can broaden and grow the economy into the future (Tech & Digital Media, Biomedicine, and Environmental Management).

Pro Tip: Once you have your business case and sectors, develop a generic “pitch deck” that you can give to a prospect to start the conversation. The original GNO, Inc. pitch deck played off a framing of “The Four C’s”: Cost (we are low-cost), Culture (we are high-culture), Cash (we have rich incentives), and Cleadership (we have excellent leadership, but no good “C” word for it).

Step 2: Prospecting

Once the pitch and sectors are defined, the search for business development prospects begins. Your outreach campaign will have two primary targets. The first is group of professionals called “site selectors” or “location consultants,” who work directly with companies to help them select a new business location and can be independent consultants or part of a large real estate or tax & accounting firm. Because they usually have a collection of clients, marketing to site selectors can have a multiplier effect and provide access to a larger pool of potential companies. Communities want to stay connected to site selectors so their region is top-of-mind when a consultant gets a new project.

The second target group is the companies themselves. Utilizing databases (EMSI, Dun & Bradstreet, etc.) and other research tools (LinkedIn, LexisNexis, etc.) to review company press releases, financials, and investor reports/calls, you can develop a list of firms likely to expand in the near future. (There are also consultancies that can assist with building target lists and acquiring key information.) Once the target list has been developed and the value proposition has been created for each sector, outreach can begin.

Step 3: Outreach

The best metaphor for outreach is fishing. Sometimes, you need a big spear to catch a whale (e.g., Amazon HQ2). But more often, it’s like setting a bunch of lines, ensuring the right bait, and waiting.

Outreach can include a variety of tactics, including:

· Attending trade shows and conferences within target sectors

· Business development trips to locations with industry clusters

· Building relationships within the industry, including via trade groups

· Leveraging existing industry contacts for potential leads, co-locations, joint ventures, and licensing arrangements (especially with international prospects)

· Hosting industry events and using conferences as economic development

· Virtual visits and tours (of particular use in the COVID era)

· Drinking lots of warm, buttery Chardonnay in hotel ballrooms

Step 4: Response to Project Proposals

When outreach converts to an inquiry (i.e., there is a tug on the line), it typically comes to either the state (in our case, Louisiana Economic Development) or directly to the regional or local economic development agency. These inquiries are called Requests for Proposals (RFPs) and typically include: company and project description (e.g. a new production facility), number of new jobs, investment, site requirements, “non-negotiable” requirements (e.g., proximity to rail), “exclusion criteria” (things that will disqualify you, like being in a flood plain), and timeline for selection and execution of the project.

The RFP is distributed to all local entities (in Louisiana, parish-level economic development groups), whereby some will decide to respond. RFP responses can vary from a very simple Word document to a presentation as elaborate as an Olympics proposal. During the Amazon HQ2 process, Tucson sent Jeff Bezos a large cactus as part of their proposal. (It didn’t work.)

Pro Tip: The turnaround time for RFP responses is usually very quick, so it pays to have basic information (available sites, utility rates, workforce data, etc.) pre-gathered so there isn’t a panic to fulfill requests.

Once the RFP is returned, it’s game on. The first elimination rounds are based on quantitative factors, including costs of doing business (workforce, logistics, real estate, utilities, and taxes), key infrastructure, available workforce, and incentives.

Subsequent eliminations are based on more qualitative factors: Does the corporation like the community? Has political leadership demonstrated interest and commitment? Is the local community harmonious or prone to opposition?

The final decision often comes down to intangibles or idiosyncrasies. Did the CEO go to school at a local university? Do they love the culture? Have strong friendships developed? Ultimately, it boils down to trust: in both a local community’s intentions and in their ability to deliver.

When we enjoyed our biggest business development win to-date – 2,000 jobs – we took the client to a celebratory dinner. After giving them lots of red, white, and bubbly truth serum, we asked, “Why did you chose New Orleans?” The client lead smiled and said, “Well, you qualified based on your costs and your incentives, but you won based on your partnership and personality.”

Step 5: On-going Project Management

GNO, Inc.’s average Business Development timeline is 12 to 18 months from introduction to announcement. Some announcements can happen nearly instantaneously, but we’ve also had some major business development wins take five or more years to come to fruition.

Pro Tip: When you celebrate an economic development win, spread the credit! Thank everyone! Not only does success have many authors, but you will need all hands going forward to make sure the partnership is an enduring success.

Then, the hard work really begins: ensuring that the company is able to thrive, grow, and meet all of the exciting commitments made to and by the community.

Ultimately, the job of an economic developer is to ensure that the right project goes to the right location. There is no point to trying to fake or force a company into a deal that is not fundamentally sound, as it won’t last.

Business Retention & Expansion

If Business Attraction is fishing, then Business Retention & Expansion is about tending the flock. Business Retention & Expansion requires organization, partnership, and consistency, with the goal of ensuring that local companies are given the best chance prosper over time.

Business Retention & Expansion is important on many levels. At a minimum, it can ensure long-standing companies feel valued, and their issues addressed. At best, it can lead to new growth opportunities, as companies will make the decision to add capacity once they have the financial, political, and practical support of economic developers. For example, in Greater New Orleans, Zatarain’s, Laitram, and Elmer Chocolates have all recently expanded their manufacturing operations, in part supported by a German-style apprenticeship program in Mechatronics, set up and managed by GNO, Inc.

Step 1: Targeting

BRE starts with developing a database of target companies. This will typically include:

· Largest companies by employment

· Leading companies by target sectors

· High-growth companies

· Local headquarters (National/Global HQ)

· Foreign/Global companies with local presence

· Companies with pre-existing history (e.g., former Business Attraction wins)

· Promising startups

· “At-risk” companies

Step 2: Outreach

With your target list in hand, outreach can begin. It can be helpful to put together a dedicated Retention & Growth Team, which may include representatives from your state economic development office, local parish/county/city economic development office, and utility representatives. This group will bring expertise and resources to help companies navigate issues that might be affecting their growth.

The Retention & Growth Team then sets up and conducts interview meetings with target companies, with the goal being to bring to light any barriers that are hindering firms’ ability to prosper, and to discover new opportunities for growth and expansion.

In our experience, the most common issues surfaced in retention meetings are:

· Attracting and retaining experienced talent

· Accessing a trained pipeline of new employees

· Accessing capital

· Navigating incentives

· Navigating permitting issues with local and/or state government

A note on business retention and incentives: existing companies will sometimes complain – rightfully so – that discretionary incentives are given to new companies to attract them into the market, rather than to existing companies (who have “been here since the beginning”) to get them to stay. This tends to be accurate, as it is fairly straightforward to incentivize a single company to enter the market, but far more difficult to say that one existing company should get public funds to stay in the market over others. It is a slippery slope, politically. The best way to manage this conundrum is to steer existing companies towards statutory, “as-of-right,” incentives (like the Quality Jobs Incentive in Louisiana), which are available to all companies.

Pro Tip: Be on the lookout, as Business Retention & Expansion meetings can sometimes uncover Business Attraction opportunities. For example, an existing company might benefit from having large customers or suppliers located closer to its operation. The team can work with this company to make a pitch to bring these operations to the region.

Step 3: Management and Following Through

Following each Business Retention & Expansion meeting, notes and next steps should be entered in a CRM (Customer Relationship Management) database, like SalesForce, to ensure next steps are tracked and acted upon, issues are being mitigated, and opportunities are being seized. A successful Business Retention & Expansion program requires consistency so you can maintain and nurture the relationship with the target company over the long term.

Pro Tip: Ensure Business Retention & Expansion meetings are coordinated among all relevant economic development organizations. You never want to ignore a company, but you also don’t want to force them to sit through a series of redundant, uncoordinated “check-in” meetings.

Entrepreneurship

Entrepreneurship not only brings new jobs and new wealth to a community – it also brings new ideas and energy, and is therefore essential to economic vitality and growth.

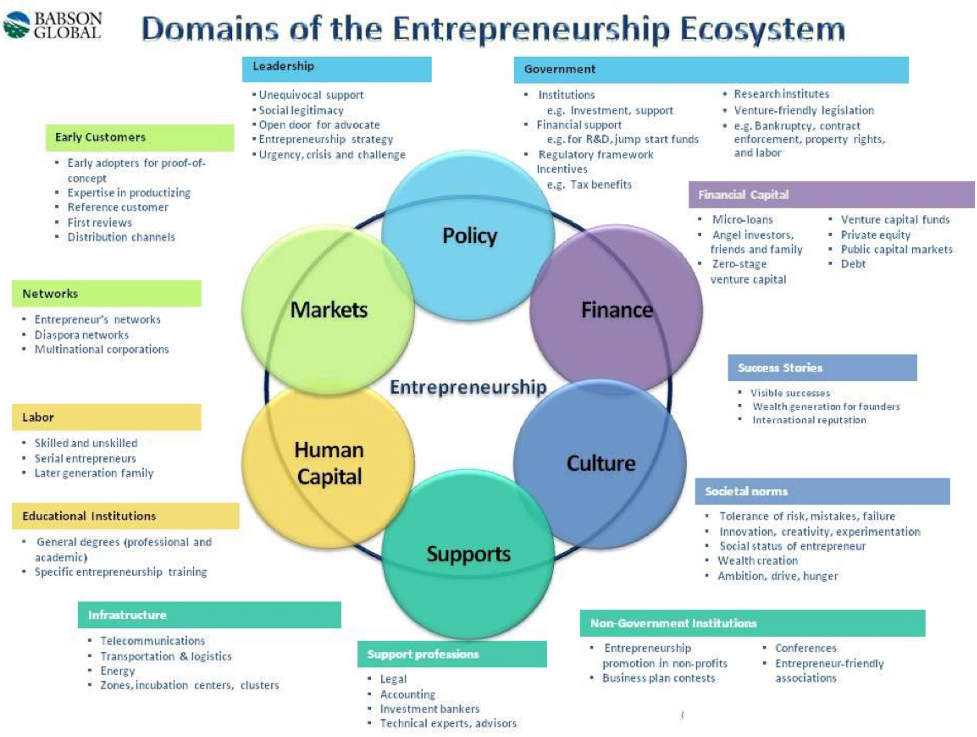

The economic development approach to Entrepreneurship is different from traditional Business Attraction and Business Retention & Expansion in that it follows a less linear path. Rather than a series of steps, Entrepreneurship is about creating a dynamic “ecosystem” that will support business starts.

The many elements of the Entrepreneurial Ecosystem include:

· Access to Capital – from “friends and family,” to pre-seed, to angel, to institutional

· Incubators and Accelerators – who “put entrepreneurs first”

· Public Policy – that supports entrepreneurs, like the Louisiana Angel Investor Tax Credit

· Management Training – for example, on how to build a sales team

· Mentoring – from seasoned entrepreneurial warriors, to both teach and provide role models

· Access to Talent – in order to fill technical needs, and grow a business

· University Partnerships – to provide ideas and research for commercialization

· Access to Early/”beta” customers – who can demonstrate market traction

· Networking – to provide a sense of support and community

· Outreach – to ensure that entrepreneurship is inclusive

· Branding – of a city or region as a “hotbed” of entrepreneurship

· Culture – that celebrates entrepreneurship

Babson College, known as a leader in the study of entrepreneurship, has a model of the entrepreneurial ecosystem that visually demonstrates the multitude of elements:

Perhaps the final element of the entrepreneurial ecosystem is… time. While we all celebrated over $2.5B of exits in Greater New Orleans in 2021, we know that some of these companies started decades ago.

Business Development in the Post-COVID World

As discussed in the first chapter, COVID has changed economic development (and everything else).

“Elephant Hunting” – trying to attract corporate headquarters and large relocations – has been supplemented (if not replaced) by a focus on building “Butterfly Gardens” – environments and amenities that will attract talented workers, who are now flitting between locations. While the declared “death of big cities” is premature, there is little doubt that some significant amount of remote work is here to stay. This presents a great opportunity for second- and third-tier cities that are not big enough to support a headquarters but could be the perfect place for remote workers to live, work, play – and pay taxes.

Post-COVID, attracting people is how you attract business.

There is an infrastructure implication to this, as cities trying to attract remote workers must have the right broadband, co-working space, and other business amenities that people have come to expect. There is also a quality-of-life aspect to this, from entertainment to recreation to the basics, like public safety. Finally, there is a narrative element to this: When a tech worker is freed from the cost and confines of New York or San Francisco, which cities are in their decision set? Some cities, like Austin, Denver, Nashville, and most recently, Miami, have developed such strong talent-attraction narratives that they are almost default options.

Importantly, there is a “network effect” to talent attraction. Once a garden starts attracting butterflies, it blooms, becoming even more attractive. As an example, I asked a post-exit tech executive leaving the Silicon Valley if he was coming home to New Orleans.

“Oh,” I replied. “For the zero income taxes?”

“Nope, I don’t care about the taxes,” he responded. “But all of my friends are going there for the zero taxes, and I just want to be with them.”

The Top Ten Rules of Business Development

Because it worked for David Letterman (before the creepy beard), we’ll end this chapter with our “Top Ten Rules of Business Development”:

- Site Selection is Actually Site Elimination – Executives and consultants start with a broad list of possible locations, and then pare down to the winner. So, ensuring that your location doesn’t have a fatal flaw that eliminates it is important. Examples of “fatal flaws” could include wetlands, cemetery/burial grounds, or political infighting.

- A Project that is Just About Incentives is Not A Real Project – Projects are about fundamental competitive rationale; incentives should just be “sweeteners” that demonstrate local interest and investment. (Corollary: a project that is a “great deal that just needs to be funded” is usually not a real project, either.)

- Workforce Quality and Quantity is Often the Winning Factor – Costs are important, incentives are nice, and festivals can be fun. But at the end of the day, Who is going to do the work? Demonstrating that your community has a skilled and dedicated workforce is essential.

- Site Selectors are Your Friends – Site selectors can provide both advice and projects; they are your friends. The best site selectors know your community assets, understand where you can compete, and are even honest about which projects they won’t bring to you.

- Prospects will Try to Leverage You – Try to understand the “back-story” on a prospect. A little digging will sometimes turn up that a company is not really looking to move or expand into your region, but is just trying to up the ante with somewhere else. Sorry.

- Projects Qualify on the Numbers, but are Won on the Relationships – There are two types of trust: Trust in intention, and Trust in ability. The prospect must have both types of trust in you if you want to win.

- Business Development is a Long-Game – Some projects can take years to come to fruition, and some can even “die” and then “resurrect.” It’s a long and winding road to a ribbon-cutting. Be patient!

- Projects End Up Where They Need to Be – After the data has been analyzed and the sites have been surveyed, a good project will go to the community and site that makes the most sense.

- Always Be Selling, but Always Be Truthful – Economic development karma is real.

- Teamwork Makes the Dream Work – Alignment and cooperation between state, regional, and local business development representatives is essential. Prospects will sniff-out discord, and won’t like it. But cooperation smells like success.

Happy hunting!

Want to learn more about GNO, Inc. or economic development? Email Michael Hecht at mhecht@gnoinc.org.